Format of E-Invoice as per GSTN

- Posted on Feb 25, 2021

- |

- By Deep Patel

E-invoice – JSON Schema

Large taxpayers with annual aggregate turnover greater than Rs 100 crore are required to issue Tax Invoice in electronic format, also known as e-Invoice. The Goods and Services Tax Network has come up with a standard of e-Invoice document in JSON format. This article describes the structure or format of an e-Invoice. An e-invoice consists of the following parts:

| E-Invoice JSON – Formats | |

| Header details | Invoice Number, Invoice Date, Supplier, Recipient, Invoice Reference Number (IRN) |

| Transaction-level | This section has Transaction category type |

| Document-level | This section has the Document Type, Number, Date etc |

| Seller | This section contains the Seller GSTIN, Tradename, Address etc |

| Buyer | This section contains the Buyer GSTIN, Tradename, Address etc |

| Dispatch | Contains Dispatch GSTIN, Tradename, Address etc |

| Ship-to | Contains the Ship to GSTIN, Tradename, Address etc |

| Invoice line-items | This section contains details of Line items |

| Document summary | This section contains all total values of the documents |

| Payment information | This section contains Payment details and conditions |

| Reference details | This section contains various Reference related to invoice |

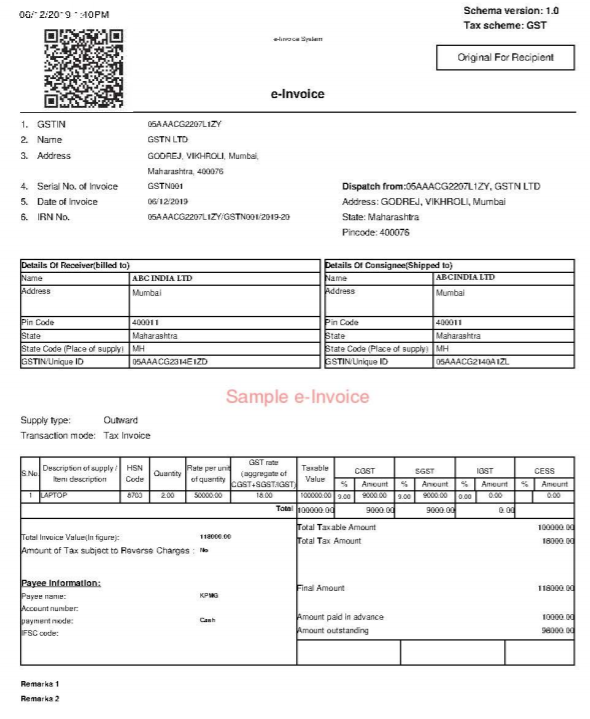

E-invoice template

The government portal has released an e-invoice template for Taxpayer’s reference. It also indicates Mandatory and Optional information Taxpayers would need to fill in to create the e-invoice.

Tax payers may consider this e-invoice format as a sample e-invoice format and not a fixed e-invoice template.

- Posted on Feb 25, 2021

- |

- By Deep Patel

- |

- 0 Comments

Leave a Reply