In an era dominated by digital advancements, our blog takes you on a journey through the intricate landscape of online banking with the intriguing title, "Navigating the Digital Frontier: Unveiling the Power of Online Banking." Immerse yourself in the transformative realm where convenience meets security, and financial management transcends traditional boundaries.

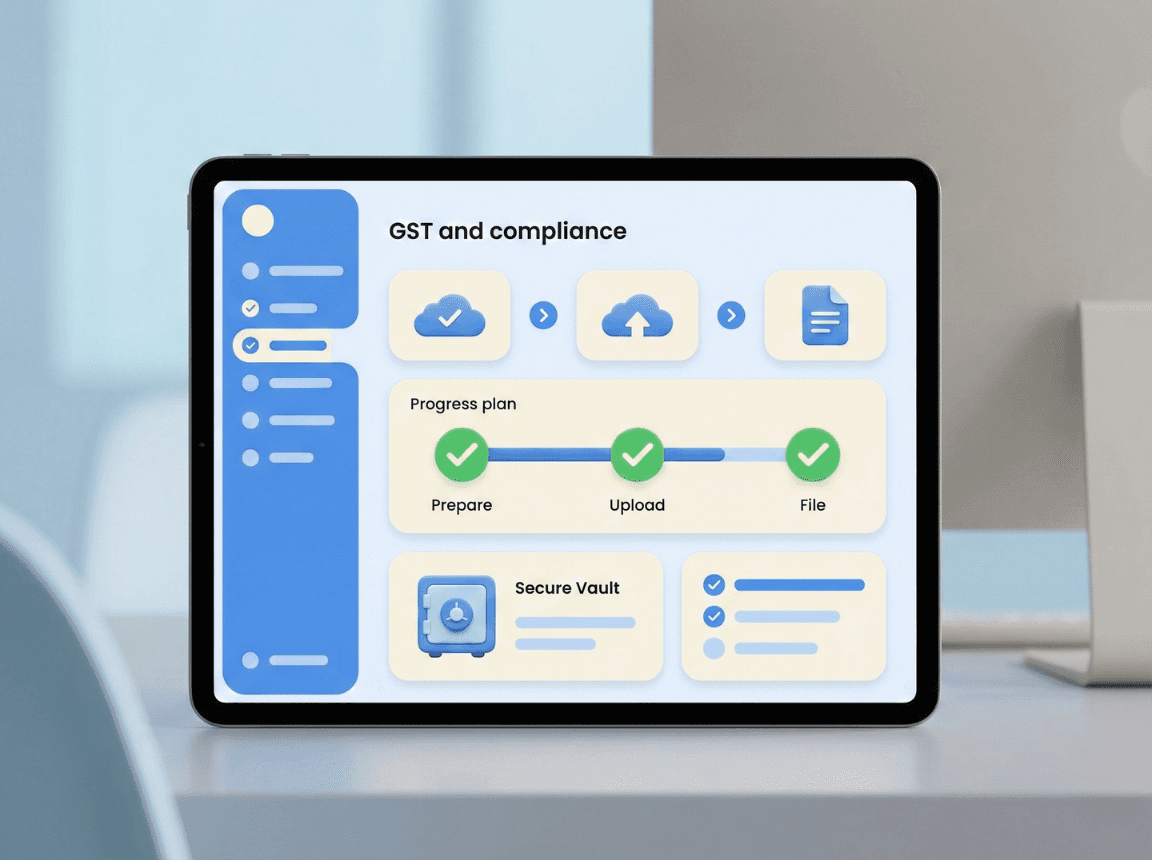

"GST Made Simple: Managing Compliance Without Complexity"

GST compliance is essential for businesses but often feels complicated. Filing returns, managing reports, generating e-invoices, and handling e-way bills can become time-consuming when handled manually.

However, with the right systems, GST compliance can become simple and predictable.

Why GST Feels Difficult?

GST requires accurate record keeping across sales, purchases, and tax reporting. When data is stored across multiple tools or managed manually, errors and delays become common.

This increases stress, especially near filing deadlines.

How Automation Simplifies GST

Automation helps businesses generate GST-ready invoices, prepare reports faster, and reduce manual calculations. When accounting and GST workflows are connected, compliance becomes easier to manage.

E-Invoicing and E-Way Bills Made Easier

Modern accounting systems allow businesses to generate e-invoices and e-way bills directly from transaction data. This reduces duplicate work and improves accuracy.

How Zybra Helps

Zybra integrates accounting, GST, invoicing, and compliance workflows into one system. This reduces manual effort and helps businesses stay compliant with less stress.

Key Takeaways

GST complexity often comes from manual processes

Automation reduces errors and saves time

Integrated systems make compliance easier